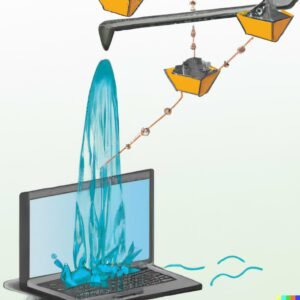

Unlocking Liquidity & Earning Passive Income with Liquidity Mining Cryptocurrency

Introduction

Liquidity Mining cryptocurrency is a new way to earn passive income. It’s also very exciting because it gives you the opportunity to participate in the crypto market in ways that were previously unavailable. In this guide, we will discuss all things related to Liquidity Mining, including what exactly it is, how it works and why you should consider becoming a Liquidity Miner yourself.

What is liquidity mining?

The first step in liquidity mining is to create a Liquidity Mining Pool and then invite your friends to join. Once the pool has been created, you can start earning LQD tokens by referring people who will also be able to earn LQD.

The second step is that you need to convert your earned LQD tokens into fiat currency or cryptocurrency (Bitcoin / Ethereum) through exchanges like Binance or KuCoin. The current price of one LQD token on the market is 1 USDT (Tether), which means that 100 LQD Tokens would cost 1 USDT at this point in time

The Liquidity Mining Protocol

The Liquidity Mining Protocol is a decentralized, open-source protocol that allows any user to earn passive income by providing liquidity to the network. The protocol uses a combination of automated market makers (AMMs) and stablecoins to create an ecosystem where users can earn rewards by providing liquidity to other traders.

In order to understand how it works, we first need to take a look at how exchanges work in traditional finance markets today. Exchanges are typically centralized institutions where buyers and sellers trade assets with each other for profit; however, there are some shortcomings when it comes down purely being able to exchange currencies quickly:

The benefits of Liquidity Mining

Liquidity Mining is a new way to earn passive income with cryptocurrency.

Liquidity Mining allows you to earn passive income from your crypto assets by utilizing them as collateral for loans and earning interest on the loans. If you have cryptocurrency, then you can earn passive income by locking it up in a liquidity pool and receiving interest payments on top of your original investment amount.

How to get started with liquidity mining

There are a few things you need to do to get started with liquidity mining.

First, you’ll need an account with one of the top cryptocurrency exchanges (we recommend Coinbase). Then, set up your account so that any time you buy or sell cryptocurrencies with it, they’re automatically deposited into your Liquidity Mining wallet. Next, decide how much money you want to put into this project–we recommend starting small and increasing as time goes on so that if it doesn’t work out for some reason, not too much will be lost!

Once those steps are complete, all that remains is waiting for returns from trading cryptocurrencies on exchanges like Binance or BitMEX. As long as there’s an active market for each coin being traded (and most do), there should be opportunities for making gains over time through both buying low and selling high strategies which can lead us towards earning passive income by being liquidity miners who trade crypto coins 24 hours per day 7 days per week 365 days per year – even while sleeping!

Automated Market Makers (AMM) and Uniswap

Another way to earn passive income is through AMM. AMM stands for Automated Market Maker, and it’s a trading algorithm that allows you to trade on Uniswap.

Uniswap is an exchange that uses liquidity pools to bring together buyers and sellers. This means that if you want to sell some Ether tokens in exchange for Bitcoin, the platform will find someone who wants to buy those Ether tokens at the same time as you’re selling them–and then automatically execute both trades simultaneously so neither party has any wait time before completing their transaction.

AMMs place bids or offers (also known as limit orders) in order to earn profit from these automated trades using Uniswap’s system; once they’ve been filled by other users on the network, they’ll receive their share of profits from every completed trade based on how much money was made off each transaction!

Learn how to earn passive income by being a Liquidity Miner.

Become a Liquidity Miner

- Learn how to earn passive income by being a Liquidity Miner.

The concept of earning money while you sleep is one that has been around for decades, but it’s only recently that technology has enabled us to do so on such a large scale. Cryptocurrency mining is an example of this type of activity and it’s one that anyone can participate in from home or office with just the click of a button!

The Pros and Cons of Participating in the Crypto Liquidity Mining Market

What are the pros and cons of participating in the crypto liquidity mining market?

Pros:

- You can earn passive income by simply holding your assets. This means that you don’t have to trade or do anything else. If you just want to hold your assets and let them grow, then this is a great option for you!

- Liquidity Mining gives new traders an opportunity to make money without risking their own funds. If you’re new at trading cryptocurrencies and want some extra cash, then this could be exactly what you’re looking for!

What are The Best Tools for Managing Crypto Liquidity & Earning Passive Income?

Liquidity Mining Pool

The Liquidity Mining Pool is the easiest way to participate in liquidity mining. It’s an automated market maker that allows you to earn passive income by helping create liquidity in the crypto market. The more you trade with our platform, the more you earn!

AMM (Automated Market Makers) and Uniswap

Conclusion

We hope you’ve enjoyed reading this article and learned a lot about liquidity mining and its benefits.

Disclaimer : I am not a registered advisor for this. this is purely my view on this and it is for informational purpose only…

![]()